Trump’s Liberation Day tariffs and their global impact

Trump’s Liberation Day tariffs significantly impact global trade by raising import costs, influencing consumer prices, and provoking responses from trading partners, which may result in new alliances and shifts in supply chains.

Trump’s Liberation Day tariffs have stirred conversations around the world, raising questions about their effects on economies and trade relationships. What might this mean for consumers and businesses alike?

Understanding Trump’s Liberation Day tariffs

Understanding Trump’s Liberation Day tariffs involves examining the motivations behind these policies and their immediate effects on both domestic and international markets. Tariffs are essentially taxes on imports, aimed at encouraging consumers to buy locally produced goods.

The specifics of these tariffs can impact various sectors in different ways. For example, industries such as steel and aluminum manufacturing may benefit from reduced foreign competition. However, the costs could rise for consumers, especially in sectors dependent on imported materials.

Motivations for the Tariffs

One of the primary reasons for implementing tariffs is to protect American jobs. By making foreign products more expensive, the intent is to boost local manufacturing industries.

Potential Negative Impacts

- Increased prices on consumer goods.

- Retaliation from other countries leading to a trade war.

- Potential job losses in industries reliant on imported materials.

These aspects create a complex landscape for businesses and consumers alike. While some may argue that tariffs help strengthen the national economy, others fear the potential for increased inflation and a decline in the availability of diverse products.

It’s crucial to track how these tariffs evolve over time and their eventual impact on global trade relations. Through discussions and variations in policy, the implications of Trump’s Liberation Day tariffs continue to unfold, marking a significant chapter in U.S. trade policies.

Immediate economic effects on the U.S.

The immediate economic effects of Trump’s Liberation Day tariffs on the U.S. can be seen across various sectors. These tariffs create a ripple effect, impacting both producers and consumers. With changes in import costs, many businesses found themselves facing higher prices for raw materials.

When companies experience increased costs, they may pass on these expenses to consumers. This can lead to higher prices in stores, affecting everyday purchases. As consumers notice these price hikes, their spending habits can change.

Impacts on Key Industries

Some industries feel the effects of tariffs more than others. The manufacturing sector, for instance, can benefit from reduced foreign competition. However, other sectors may struggle.

- The agriculture industry may face challenges as major trading partners retaliate, affecting exports.

- Consumer goods could become more expensive as inputs rise.

- Construction projects may slow down due to rising costs for materials like steel and aluminum.

As the market adjusts, companies must decide how to respond to these new economic realities. Many businesses are looking for ways to adapt, whether by cutting costs, finding alternative suppliers, or even passing costs onto consumers.

The economic landscape shifts constantly, making it critical for businesses to stay informed and adapt quickly to minimize disruptions.

Reactions from global trading partners

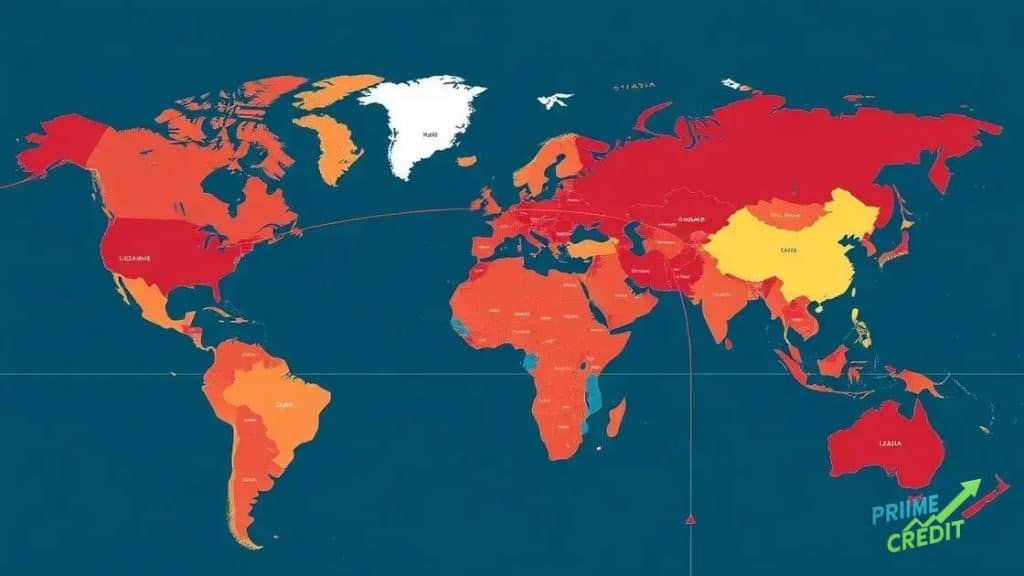

Reactions from global trading partners to Trump’s Liberation Day tariffs are varied and significant. As countries view these tariffs, they often respond in ways that can affect international trade dynamics. Many nations see these tariffs as a challenge to their own economic interests.

Some countries may impose reciprocal tariffs on U.S. goods to protect their markets. This response can escalate tensions and potentially lead to a trade war. For example, major economies like China and the European Union have expressed concerns about the implications of these tariffs on their exports.

Key Reactions from Major Players

Each country has its strategies and concerns regarding the tariffs. Let’s take a closer look at how some global trading partners are reacting.

- China has targeted U.S. agricultural products, implementing tariffs to impact American farmers.

- The European Union has threatened to impose tariffs on a range of goods, from motorcycles to whiskey.

- Countries in North America, like Canada and Mexico, are negotiating to adjust trade agreements impacted by these tariffs.

As reactions unfold, it’s clear that Trump’s tariffs do not exist in a vacuum. The interconnectedness of global trade means that one country’s decisions can lead to numerous ripple effects. This complex web of reactions makes it necessary for the U.S. to engage diplomatically with its trade partners.

Understanding the responses from global trading partners helps assess the broader impact of the tariffs on international relations. It showcases how economic policies and local economies are intertwined across borders, influencing everything from factory jobs to consumer prices.

Case studies of affected industries

Examining case studies of affected industries provides a clear picture of how Trump’s Liberation Day tariffs influence various sectors. Each industry reacts differently to these tariffs, showcasing both challenges and opportunities.

The steel and aluminum industries are among the most directly impacted by these changes. With tariffs in place, the prices of domestic products increased, giving U.S. manufacturers a chance to compete more effectively against foreign imports.

Steel Industry Case Study

The steel industry saw a surge in production as U.S. companies capitalized on reduced foreign competition. Businesses like U.S. Steel and Nucor reported increased profits due to higher domestic prices. However, this came at a cost to construction companies that rely heavily on steel imports, leading to higher prices on structures and projects.

Textile Industry Case Study

The textile industry faced unique challenges. While some local manufacturers benefited, many clothing companies reported rising costs. The tariffs led to increased prices for materials, impacting retail prices for consumers. Companies had to decide whether to absorb costs or pass them on to customers.

Agricultural Sector Case Study

Agriculture has also been reshaped by these tariffs. For instance, American farmers faced retaliatory tariffs from countries like China, targeting key exports such as soybeans. This has caused significant financial pressure on farmers and shifted trade dynamics.

- Increased prices for raw materials in manufacturing.

- Profitability fluctuations due to changing demand in affected industries.

- Strategies for businesses to adapt to new costs and market conditions.

By investigating these case studies, we see how the ripple effects of tariffs extend through various industries. Each case highlights the importance of adaptation in a changing economic landscape, as businesses strive to mitigate the impacts of these policies.

Future implications for international trade

The future implications for international trade following Trump’s Liberation Day tariffs are complex and evolving. As countries assess their trade strategies, many are re-evaluating their relationships with the U.S. This can lead to significant shifts in trading patterns and alliances.

One potential outcome is the restructuring of trade agreements. Nations may seek to strengthen ties with other partners to offset the impact of U.S. tariffs. For instance, countries that have been affected could form new coalitions to better protect their economic interests. This could change the landscape of global trade dramatically.

Shifts in Global Supply Chains

As tariffs alter costs, businesses may reconsider their supply chains. Companies could seek to source materials from different countries to avoid tariff penalties, resulting in a new map of global trade links.

- Increased diversification of supply sources to minimize risk.

- Potential rise of trade among emerging markets.

- Adaptation strategies for industries that are heavily reliant on imports.

Future trade dynamics will likely emphasize resilience and flexibility. Companies must be prepared for rapid changes in regulations and market demands as governments respond to tariff impacts.

Long-term Economic Trends

The long-term economic trends could include a return to tariffs if global tensions continue. Countries may impose their tariffs in retaliation, leading to a more fragmented trade environment. A fragmented trade system could make goods more expensive for consumers worldwide.

In conclusion, the future of international trade will rely heavily on how nations respond to current tariffs and adapt their strategies to stay competitive in a changing environment. Businesses and governments must stay vigilant and proactive in navigating this new economic reality.

FAQ – Frequently Asked Questions about Trump’s Liberation Day Tariffs

What are Trump’s Liberation Day tariffs?

They are taxes imposed on specific imports aimed at protecting U.S. industries from foreign competition.

How do these tariffs affect consumers?

Consumers may face higher prices on goods due to increased costs for imported products.

What might be the global response to these tariffs?

Countries may retaliate with their own tariffs, leading to potential trade tensions and shifting alliances.

How should businesses adapt to these changes?

Businesses should diversify suppliers and adjust pricing strategies to navigate the impacts of tariffs on their operations.